FEEDBACK REPORT

Legal Compliance Workshop for NGOs

[Thursday, 24th August 2017, Lecture Room- 1, IIC (Annexe), 40 Max Mueller Marg, N. Delhi – 3]

Dear Friends with a special Hello to all the Participants who attended the workshop, which was one of the most interactive workshop organized by SRRF so far. Credit for this goes to all the participants, who engaged the faculty and remained focused throughout the day. Through this communication we share feedback given by you.

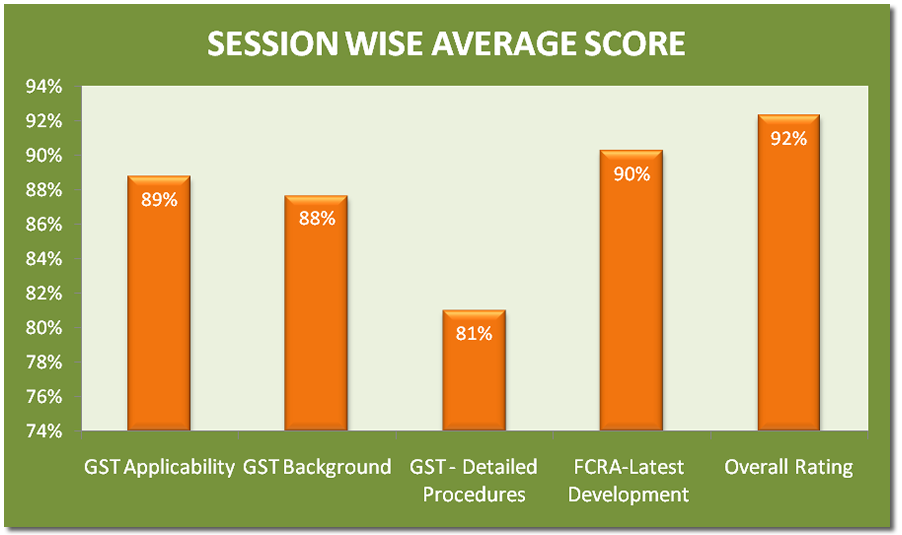

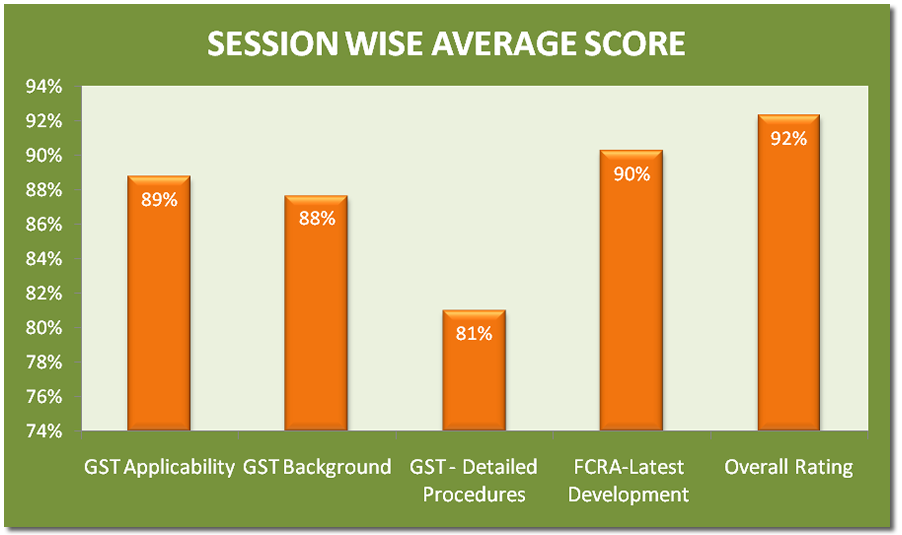

The Feedback forms have been compiled and collated. There were 41 participants, 49% of whom have given their feedback. Feedback required scoring for each session as well as for overall workshop. The feedback gives score of 92% for the overall workshop. A chart of session-wise results is given below.

Following suggestion received by participants on various topics:

Following suggestion received by participants on various topics:

| Particulars |

Suggestions |

| Please tell us how to further improve? Any specific suggestion for improvement? |

– If all topics needs to be covered the training can be for more than a day.

– Place water bottles on the desk

SRRF Comment: While we thank you for your suggestions, however the plastic bottle is not very environment friendly and so far we have avoided it. Water is always available just outside the hall.

– Practical example to improve the knowledge

– More clarity from Government

– Very well structured & it is also always a privilege to come and attend such esteemed speakers.

– Could take fewer topics to stick to timeline.

– Time management can be looked at

SRRF Comment: We always keep it in mind, however our effort is to solve issues raised, hence sometime discussions can be a bit longer. Our overall aim is to cover all the topics in the day itself.

– Can take more Q & A

SRRF Comment: Effort is always to have an interactive workshop. All the questions raised during the day were taken up. |

| Please suggest topics for any other events that you would like SRRF to Organise. |

– A session on Sub grants to Partners

– More on GST

– All GST sections

– NGO Management Systems in Place |

| Would you like this program to be replicated in any other state, if Yes please indicate. |

Mumbai, Kerala |

We have already uploaded the presentations of the workshop at our website including snaps. Please visit SRRF website to get access to the same. http://www.srr-foundation.org

We have also uploaded the snaps of the participants on SRRF facebook page. https://www.facebook.com/srr.foundation/.

Once again I thank you on behalf of SRRF, on being part of a wonderful and learning ‘Legal Compliance for NGOs’ workshop.

With warm regards

Ramanuj Maurya

Coordinator

__________________________________

Socio Research & Reform Foundation (NGO)

512 A, Deepshikha, 8 Rajendra Place,

New Delhi – 110008