Companies Act: Currently all entities are likely to be busy in closing their accounts, in this regard you may like to know about latest requirements for information to be disclosed in Financial Statements.

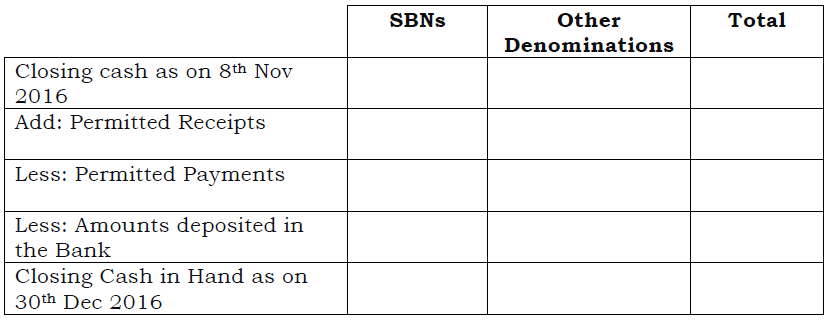

All companies (including S.25/S.8 companies) would need to disclose following information in their financial statements. Every company shall disclose the details of Specified Bank Notes (SBN), i.e. Notes of Rs 500 (old) & Rs 1000 denominations, in following manner.

The auditor is also required to audit and report if the correct information has been disclosed by the company in its accounts regarding above. Presently this information has been requested only from companies, but it is possible that it may be extended to entities other than companies.

Income Tax: However, please note all assesses have to disclose in their Income Tax Returns (ITRs) total cash deposited by taxpayers in their bank accounts. In fact a new column has been introduced in all ITR Forms to report on cash deposited by taxpayers in their bank accounts during the demonetization period, i.e., from November 9, 2016 to December 30, 2016. However taxpayers who have deposited less than Rs 2 lakh need not fill up this column.

____________________________________

Socio Research & Reform Foundation (NGO)

512 A, Deepshikha, 8 Rajendra Place, New Delhi – 110008

e-mail: socio-research@sma.net.in; website: http://www.srr-foundation.org