Dear Sir,

Greetings!

We are in the process of filing FCRA Annual Return and facing a challenge

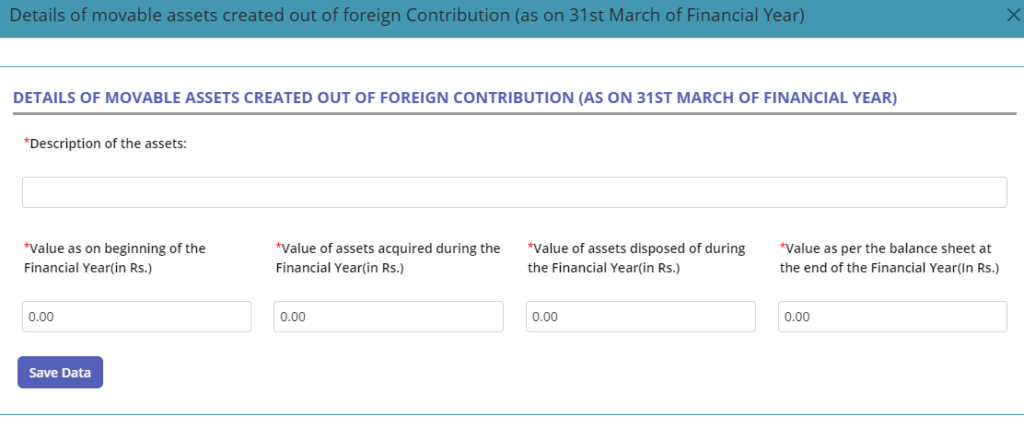

to update the forms related to list of Movable and Immovable Assets.

In the pop up window ( screenshot given below ), we have only 4 fields to enter – opening balance, assets bought during the year, assets disposed during the year and closing balance. We do not have any field to update for the depreciation value in the portal. Kindly advise where to mention the depreciation value so that the closing balance get matched with the current value of the assets ( As on 31st March 2023)

Kindly advise, in which bank account (FCRA designated bank or FCRA utilisation bank accounta) are to be deposited the amount of sold/disposed of payment which is received during the year from the FCRA Assets. Are the closing balances of FCRA fixed assets affected by the sold/disposed of amount?

The Requirement is “(ba) Details of movable assets created out of foreign Contribution (as on 31st March of Financial Year)” .

Therefore, Gross Block from FIXED ASSETS SCHEDULE could be reproduced as the value of the Asset created out of foreign contribution is the the cost of the assets available as at the end of the year. If the same is discarded / sold , automatically it forms part of Assets disposed off during the year. Showing depreciated value will not be practicable in the given format.

You may enter the opening value of assets in the first column, fill up values if assets purchased and disposed, if any in the second and third columns and mention the value after depreciation in the fourth column