| | Darpan ID : | Auto Populated | This information is auto-populated as and when an entity enters the online platform using its user id & password. |

| 1. (a) | Name & Address : | Auto Populated |

| | | | |

| 1. (b) | FCRA Registration/Prior Permission: | Auto Populated | This information is auto-populated as and when an entity enters the online platform using its user id & password. |

| |

| 2 | Details of Foreign Contribution (FC) |

| 2 (i) | | | |

| (a) | B/F FC at the beginning of the year: | To be filled | While no auto checks on validation of this infor, make sure this information is in agreement with closing balance of last FC4, although there is no automatic check on the accuracy of the same. |

| |

| (b) | Income during the year (i) Interest | To be filled | Please ensure this interest is aligned with Receipt & Payment A/c. |

| | (ii) Other Receipts from Projects/Activities | To be filled | All other income, including sale of assets, etc. Pl ensure whatever income that is disclosed here is deposited in the FCRA Bank A/cs. |

| |

| (c) | FC rec’d during the FY | | |

| | (i) Directly from foreign source | To be filled | Source-wise Total FC amount rec’d during the year to be filled here. Ensure total under this Para and Total FC rec’d purpose-wise under Para 2(ii)(b) of this Form match. |

| | (ii) from a local source | To be filled |

| |

| | | | |

| (d) | Total Foreign Contribution (a+b+c) | Auto-populated based on above data | Pl ensure this figure is in alignment with total b/f + receipts in Receipt & Payment A/c. |

| | | | |

| 2(ii) | | | |

| (a) | Donor-wise detail of FC rec’d | Individual donor-wise details to be filled | 1. Under this column, individual donor-wise details of FC have to be given. Note the donor details will need to be selected from a drop-drawn menu. Pl note in case your donor is not included in this menu, then one will need to add the donor details (Name/Address /Purpose/Project Name/Amount, etc.). 2. Note, in case you add any donor with Indian address it will treat it as a Local donor and any FC rec’d from such donor would not be included in the Purpose-wise total FC rec’d under para 2(ii)(b) below. This will mean that total FC rec’d as per para 2(ii)(b) and as per para 2(i)(c) above will not match. 3. Pl ensure mention purpose as mentioned in your FCRA registration (example, social/educational/religious etc.). Purpose would need to be mentioned under each FC rec’d under para 2(ii)(a) |

| (b) | Cumulative purpose-wise FC rec’d | Data auto-populated based on details filled under 2(ii)(a) |

| | | | |

| 3 | Details of Utilisation of FC |

| (a) | Project-wise details of Utilisation of FC | Fill-up Utilisation amount Project-wise | 1. Pl ensure that total of project-wise Utilisation matches with toal expenditure on programs [reported under para 3(a)(i)] + admin [reported under para 3a(ii)] + purchase of assets [reported under para 3(b)] 2. Pl ensure total of Utilisation is aligned with total utilisation under Receipt & Payment. |

| | | | |

| (i) | Utilisation as per aims/objectives of Assoc. | Fill-up total programmatic Utilisation | Basically this figure denotes total programmatic expenditure, but does not include any fixed assets procured from FC funds. In case program expenditure separately shown under Receipt & Payment, then it may be ensured that the disclosure at both places is aligned. |

| (ii) | Administrative Exps. As provided under Rule 5 | Fill-up total Admin expenses | 1. This represents Admin Exps, as per Rule 5 and should not exceed 20% of FC rec’d. Again this expenditure should be included under para 3(a), i.e. project-wise expenditure. Therefore, Assoc should have one project which covers any Admin exps. Not covered under other projects. 2. Ensure Admin Exps should align with R& P if separately disclosed there. |

| (iii) | Total (i)+(ii) | This is auto-populated | Expenditure represents total programmatic & admin costs. |

| (b) | Details of Fixed Assets purchased during the year | To be filled in a Table format | 1. These assets should be included under Project-wise expenditure disclosed under Para 3(a) above.

2. Under the column ‘Nature of Project / Activity’ one has to select from drop down menu options are between movable & immovable assets. Select appropriately. 3. Under Details of Fresh Assets fill up appropriate category of asset as per Fixed Asset schedule.

4. Under ‘Objective of acquring fresh asset’ select from drop down menu – purpose out of social / education etc. as per your FCRA registration. 5. Under cost of fresh assets column, pl fill up cost of assets acquired during the year. 6. Ensure assets disclosed under this column are in alignment with R&P. |

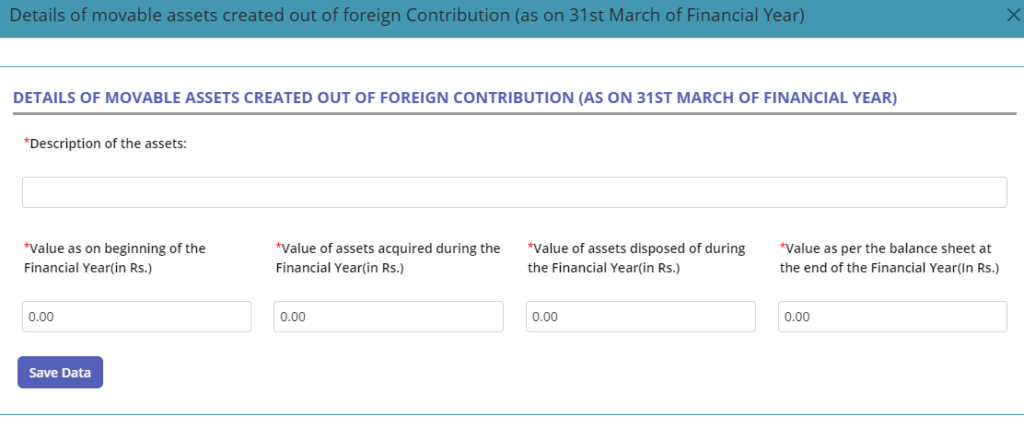

| (ba) | Details of Movable Assets created out of FC | To be filled in a Table format | 1. In case this data is matched with FA schedule and if there is a difference between figures indicated under (b) above and (ba), then give reason for same through a Note. 2. Description of Assets to be provided as per category mentioned under FA schedule. 3. Give details as per Gross Assets, as the Table does not include figure for depreciation. 4. For immovable properties, address of the property as well as plot size, etc needs to be mentioned. |

| (bb) | Details of Immovable Assets created out of FC | To be filled in a Table format |

| | | |

| (c) | Details of funds transferred to other person / association. | To be filled in a Table format | 1. Normally one does not expect any transfer under this column, this is to identify if any transfers made during the year to other associations, etc. who were prohibited after amendment under S.7 effective Sept’2020 |

| (d) | Total Utilisation (a)+(b)+(c) | This is auto-populated | Pl align with R&P – total payments covering programmatic, admin & fixed assets procured. |

| |

| 4 | Details of Unutilised FC | | |

| (i) | Total FC invested in FDs | | Pl align with R&P – total payments covering programmatic, admin & fixed assets procured. |

| a,b,c | FD details | To be filled in a Table format | Ensure all details align with your R&P and Balance Sheet |

| d | Closing bal of FDs | This is auto-populated | |

| 4(ii) | Unutilised FC | | |

| | (a) Cash in hand | To be filled in a Table format | Ensure aligns with R&P and Balance Sheet |

| | (b) Designated Bank Bal |

| | (c) Utilisation Bank A/c Bal |

| | | | |

| | (d) Total Unutilised (a)+(b)+(c ) | This is auto-populated | |

| 5 | Details of foreigners as Key functionary / associated / working | To be filled in | 1. In case you have any foreigners in Board or working in your organisation. You are required to disclose this information. 2. Although this may mean a query from FCRA Dept. |

| 6 | Details of Land & Building remaining Unutilised for 2 yrs. | To be filled in | If such properties are there, one would need to disclose the details of such properties, as well as reason for non-utilisation. |

| |

| 7 | Details of Designated, Another FCRA A/c & Utilisation A/cs to be provided | Details of designated & Another FCRA A/c to be filled, Utilisation Bank A/cs are auto populated based on information posted on portal | |

| | | | |

| 8 | Declaration on 15 different clauses | Need to choose each clause by selecting Yes/No – wherever yes is select, it would require to give further details. | |